What Are the Things to Remember While Buying Life Insurance?

Purchasing life insurance is not something you do on a whim. It's a long-term financial agreement, a commitment to your family that the lights will always be on.

In a fast-paced city like Los Angeles, where costs are high and responsibilities stack up quickly, choosing the right life insurance Los Angeles residents rely on takes clarity, not guesswork.

Here’s what actually matters.

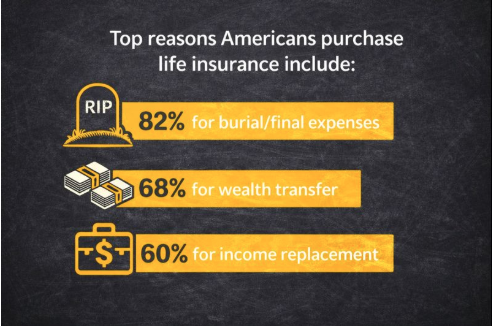

1. Understand Why You Need Life Insurance

Be brutally honest about your goal before comparing policies. Is it long-term family security, debt repayment, children's education, or income replacement? Precision in life insurance Los Angeles planning is driven by purpose.

Source: Policy Genius

2. Choose the Right Type of Policy

Term life insurance is inexpensive, hygienic, and protective. Although the premiums for whole life and universal life are higher, they offer cash value and lifetime coverage. No one-size-fits-all solution exists. Your age, income, dependents, and financial plan will determine which life insurance Los Angeles option is best for you.

| Policy Type | Coverage Duration | Premium Cost | Cash Value | Best Suited For |

| Term Life Insurance | Fixed term (10–30 years) | Lower | No | Income protection, young families, affordability |

| Whole Life Insurance | Lifetime | Higher | Yes | Long-term security, estate planning |

| Universal Life Insurance | Lifetime (flexible) | Medium to high | Yes | Flexible premiums, wealth planning |

3. Calculate the Right Coverage Amount

There are gaps when there is insufficient coverage. Your monthly cash flow is strained by too much. A wise generalization takes inflation, future costs, income, and liabilities into account. Underestimating expenses is a rookie error in places like Los Angeles. For your Los Angeles life insurance plan, do the math correctly.

4. Don’t Ignore Premium Affordability

Life insurance is only effective if it remains in effect. Select a premium that you can afford for years rather than just a few months. Here, stability triumphs over ambition. Your Los Angeles life insurance policy remains effective when your family most needs it, thanks to sustainable premiums.

5. Check the Insurer’s Credibility

Features of policies are important, but so is the organization that supports them. Examine your customer service, claim settlement history, and financial stability. Insurance companies that are built to last, not just sell, offer the best life insurance policies in Los Angeles.

6. Read the Fine Print (Yes, All of It)

Clarity is found in terms of exclusions, waiting periods, riders, and renewal terms. Make inquiries. Demand openness. A clear Los Angeles life insurance policy now avoids disagreements later.

7. Work With a Trusted Life Insurance Los Angeles Advisor

Online quotes are quick. Professional guidance is wiser. A certified advisor assists you in matching coverage to long-term objectives and actual risks. Guidance is a competitive advantage in a market as complicated as life insurance Los Angeles.

Why Los Angeles Residents Should Be Extra Careful

The risk equation is altered by longer commutes, fluctuating incomes, and higher living costs. What is effective elsewhere might not work here. Customized life insurance Los Angeles solutions are therefore more important than standard policies.

Ready to Protect What Matters Most?

Fear is not a factor in life insurance. It has to do with leadership. It's about supporting your family even when you are unable to physically be there.

e360 Insurance Services helps Los Angeles residents cut through the noise and secure the right life insurance with confidence, clarity, and cost control.

Talk to e360 Insurance Services today and get a customized life insurance Los Angeles solution that actually fits your life, not just your budget.

Common Life Insurance Concerns

- How much life insurance coverage do I need in Los Angeles?

Income, debts, dependents, and living expenses all affect coverage. Coverage frequently needs to be higher than the national average due to LA's higher cost of living. - Is term life insurance better than whole life insurance?

Term life is frequently chosen for pure protection at a lower cost. Long-term financial planning may benefit from whole life, but it's not the best option for everyone. - Does my age affect life insurance premiums?

Of course. The premiums for younger applicants are substantially lower. A wise life insurance Los Angeles strategy is to lock in early. - Can I buy life insurance if I have health issues?

Indeed. There are options, but the premiums might be higher. Finding policies tailored to your circumstances can be aided by an advisor. - Should I buy life insurance online or through an agent?

Online is quick. Agents provide clarity. For personalized life insurance Los Angeles coverage, expert guidance often delivers better value.